(678) 598-3887

Build Wealth Through Multifamily Investments

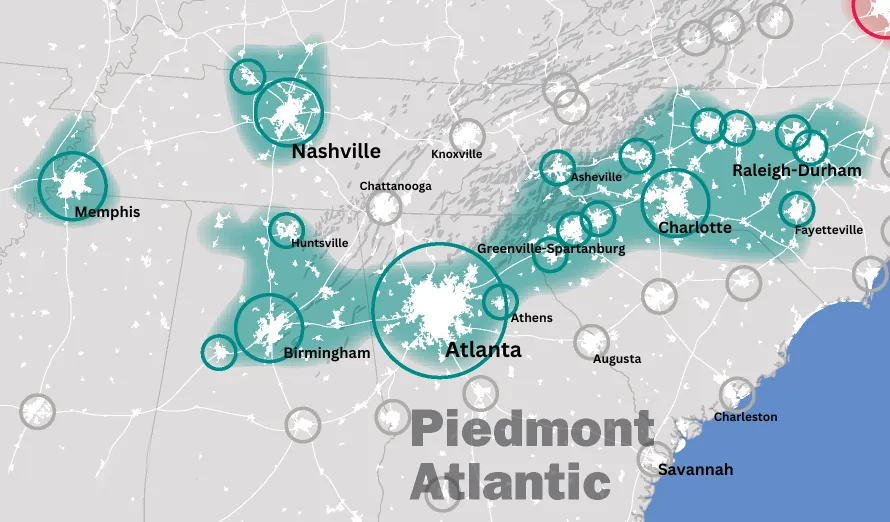

Welcome to MarKVal Equity Group, your strategic partner in identifying and capitalizing on multifamily opportunities across the dynamic Piedmont Atlantic Megaregion. Spanning key markets from Atlanta to the Carolinas, this corridor boasts robust population growth, a diversified economy, and stable rental demand—factors that help your money work for you day and night.

"Connect investors to high-growth multifamily opportunities with transparency and trust."

Our Mission

At MarKVal Equity Group, we are dedicated to creating sustainable wealth for our investors. By leveraging the economic strength, population growth, and connectivity of the Piedmont Atlantic Megaregion, we identify multifamily investments that yield stable returns and contribute positively to local communities.

Our Vision

We envision a portfolio of multifamily properties strategically placed along this megaregion’s most promising corridors, fostering steady cash flow, predictable growth, and meaningful community development.

Our Story

Founded by Dante Maxey, MarKVal Equity Group emerged from a passion for real estate and a commitment to strategic investing. Dante’s experience in sales, marketing, and operations informs a disciplined approach: acquiring properties at a fraction of their After-Repair Value (ARV) and unlocking value through light renovations, operational efficiencies, and resident-focused improvements. Driven by a belief that real estate should build both wealth and better communities, Dante leads with integrity, transparency, and a long-term perspective—ensuring investors can trust their capital to deliver income and impact.

Why Invest in the Piedmont Atlantic Megaregion?

Connectivity & Infrastructure:

Major interstates, airports, and rail lines bind the region, facilitating business growth and workforce mobility.

Skilled Workforce:

Top universities contribute to a talent-rich environment, drawing employers and increasing housing demand.

Tax Advantages:

Real estate investments offer avenues for significant tax benefits. By leveraging depreciation, cost segregation, and other strategies, some investors may substantially reduce their taxable income.

Create Passive Income:

Anchored by major metros like Atlanta and Charlotte and supported by innovation hubs in Raleigh-Durham and Greenville-Spartanburg, the Piedmont Atlantic Megaregion consistently fosters strong multifamily fundamentals—enabling you to earn income while you sleep.

Value-Add Approach:

We target multifamily assets at 50–80% of ARV, focusing on units that are under-rented, poorly managed, or under-amenitized. By streamlining operations, implementing RUBS, and enhancing amenities, we boost NOI and property value.

Our Strategy

Long-Term View:

We invest with patience and discipline, aiming to deliver stable quarterly distributions and meaningful appreciation over a multi-year hold period. By the time we exit, the property’s enhanced value and improved tenant experience provide a strong story for prospective buyers—further benefiting our investors.

Identify high-growth submarkets anchored by diverse industries.

Acquire underperforming properties at below-market prices.

Implement value-add strategies to enhance income and property value.

Deliver stable cash flow and strong appreciation to our investors over the hold period.

Data-Driven Decisions:

Our team conducts rigorous market analyses, underwriting multiple scenarios to ensure each deal meets conservative performance thresholds. We stress-test assumptions to safeguard returns against economic shifts.

For Brokers

We value long-term relationships, quick feedback, and fair negotiations. Our criteria are clear, enabling swift deal evaluation and streamlined closings.

For Lenders

With conservative underwriting and a diversified pipeline, we’re a reliable borrower who values honest communication and timely repayment. Partner with us to fund stable, well-researched projects.

OUR TEAM

Managing Director

Dante Maxey

Experience: Over 5 years in real estate investing, specializing in innovative solutions for community stabilization and wealth creation.

Founder: Established a company dedicated to helping homeowners navigate foreclosure, preserving homeownership, and supporting community stability.

Skillset: Strong background in sales, marketing, and business operations, with proven leadership, communication, and problem-solving abilities.

Current Focus:Transforming multifamily properties into sustainable wealth-building opportunities. Revitalizing communities through strategic real estate investments

Mission: Delivering value for investors while creating vibrant, thriving communities.

Managing Partner

Todd Robinson

Expertise: Commercial real estate and finance attorney specializing in transactions like property acquisitions, mixed-use developments, leasing, and joint ventures.

Clients: Represents Fortune 500 companies, private equity funds, REITs, and family offices.

Track Record: Closed over $500 million annually in commercial deals, including structured finance and syndicated loans.

Corporate Practice: Advises on joint ventures, private equity investments, and private placement memorandums.Litigation: Handles disputes in real estate, construction, and commercial contracts.

Reputation: Known for practical solutions and efficient deal execution aligned with client goals.

Copyrights 2025 | MarkVal Equity Group | Terms & Conditions